Based on various analyses, the amount of accruals may be determined without sole reliance on the receipt of invoices. Simplified methods for monthly accruals, such as estimates based on previous experience or prior month's reporting, may be used when demonstrated to be reasonably reliable.

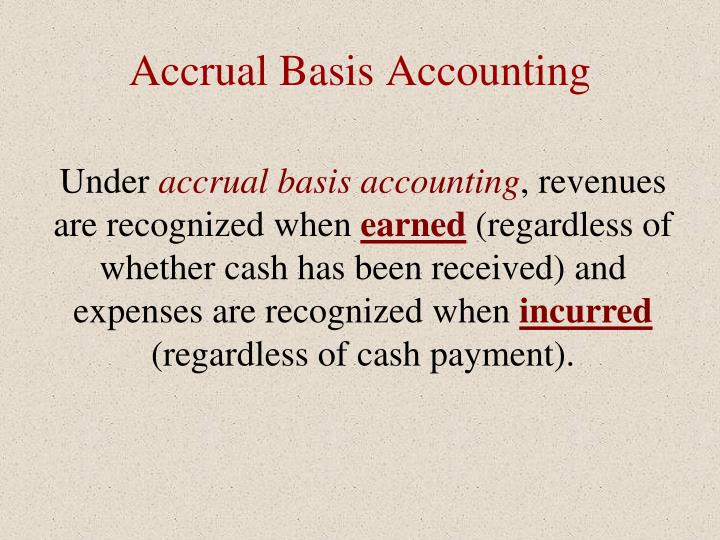

#Accrual basis accounting recognizes professional#

(2) have not yet occurred but are expected to occur within the accounting period.ġ.1.4 The actual value of events that have taken place in the past or of events that are expected to take place in the future may not be known for various reasons, such as contract reporting that lags by one month labor hours that have not yet been reported or indirect rates, award fees, or other items that are not finalized until a contract or purchase order has been closed.ġ.1.5 Preparing an accrual requires professional judgment and Center Office of the Chief Financial Officer (OCFO) will consider the nature of the underlying transactions, information collected from the field, data available as of the cutoff date for the accrual, and historical knowledge of the types of transactions for which documentation is not received by the end of the accounting period. (1) have occurred within the accounting period and for which the value is unknown or Estimated amounts accrued are values given to events that either: Actual amounts accrued are values given to events that have already occurred within the accounting period and for which the value is known.ġ.1.3.2Ěccrual of Estimated Amounts.

Accruals include amounts incurred or earned for the actual or estimated value of resources used, work performed or expected to be performed, and work-in-process amounts attested to by management through the current fiscal period.ġ.1.3.1Ěccrual of Actual Amounts. Amounts accumulate or accrue when financial events take place. The level of detail attained should not exceed what is actively monitored for project management, useful in decision making, or required for billing or reporting.ġ.1.3Ěccruals are amounts recorded prior to the payment or collection of cash.

Although accrual-based financial data is more accurate, a balance should be maintained between the effort (amount of data, labor, or other resources) required to measure accruals precisely and the added value of such precision. Subsequent regulatory and administrative guidance from the Government Accountability Office (GAO) to the United States (U.S.) Department of the Treasury (Treasury) has specifically required the use of accrual basis accounting principles.ġ.1.2 Use of accrual accounting enables NASA's management to prepare a cost-based budget and to accurately measure the Agency's performance and financial position using the financial data available. Accrual-based accounting for Federal agencies was mandated as law by the Executive agency accounting and other financial management reports and plans, 31 U.S.C. Accounting on an Accrual Basis 1.1 Overviewġ.1.1 This NPR directs NASA personnel to present resources, liabilities, cost of operations, and revenue on an accrual basis to provide the information needed to develop NASA's budget and financial reports and effectively manage programs and projects. | TOC | Preface | Chapter1 | Chapter2 | Chapter3 | AppendixA | AppendixB | AppendixC | AppendixD | ALL |Ĭhapter 1. Subject: Accrual Accounting - Revenues, Expenses, and Program Costs Responsible Office: Office of the Chief Financial Officer

0 kommentar(er)

0 kommentar(er)